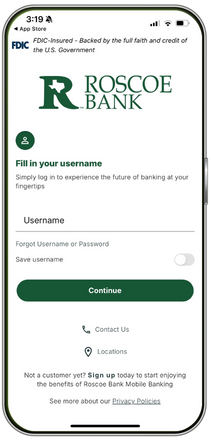

Secure Online Banking

Checking and Savings Accounts

Manage it all—from coffee runs to college funds.

Enjoy these benefits when you open an account with us:

Access to over 55,000 free Allpoint ATMs

Convenient Online and Mobile Banking with mobile deposit1

Free paper statements or e-statements

Choose the account that fits your needs and open with a minimum deposit of $50.

Checking Accounts

| Free Checking | Interest Checking | |

|---|---|---|

| Balance to Avoid Service Charge | $0 | $1,500 |

| Monthly Service Charge | $0 | $3 |

| Interest | - | $0 and above2 |

| Paper & Electronic Statement | Free | Free |

Savings and Money Market Accounts

| Basic Savings | Money Market | |

|---|---|---|

| Balance to Avoid Service Charge | $200 | $2,500 |

| Monthly Service Charge | $3 | $8 |

| Interest | $0 and above3 | Tiered Interest2 |

| Paper & Electronic Statement | Free (Quarterly) | Free (Monthly) |

CDs & IRAs

The average person spends 20 years in retirement.4 Make saving for retirement a priority by opening a certificate of deposit or individual retirement account.

Visit one of our locations for rates and terms that fit your goals.

Banking 24/7

With our online and mobile banking services, you can bank whenever and wherever you like.

Manage accounts and track spending

Transfer funds and make payments

Deposit checks with mobile deposit1

Monitor your credit score

1.) Wireless provider fees may apply 2.) Interest compounded and paid monthly 3.) Interest compounded and paid quarterly 4.) United States Department of Labor – Top 10 Ways to Prepare for Retirement (September 2021). Source deemed reliable but not guaranteed.